Want to easily create an ETF?

Build, launch, and manage it with us.

Isn’t it time you were treated as a partner, and not a profit center?

Build

Launch

Manage

WHITE LABEL ETF PLATFORM

Create. Clone.

Convert. Complete.

New Investment Strategies

Managed Account Conversions

Hedge/Mutual Fund Conversions

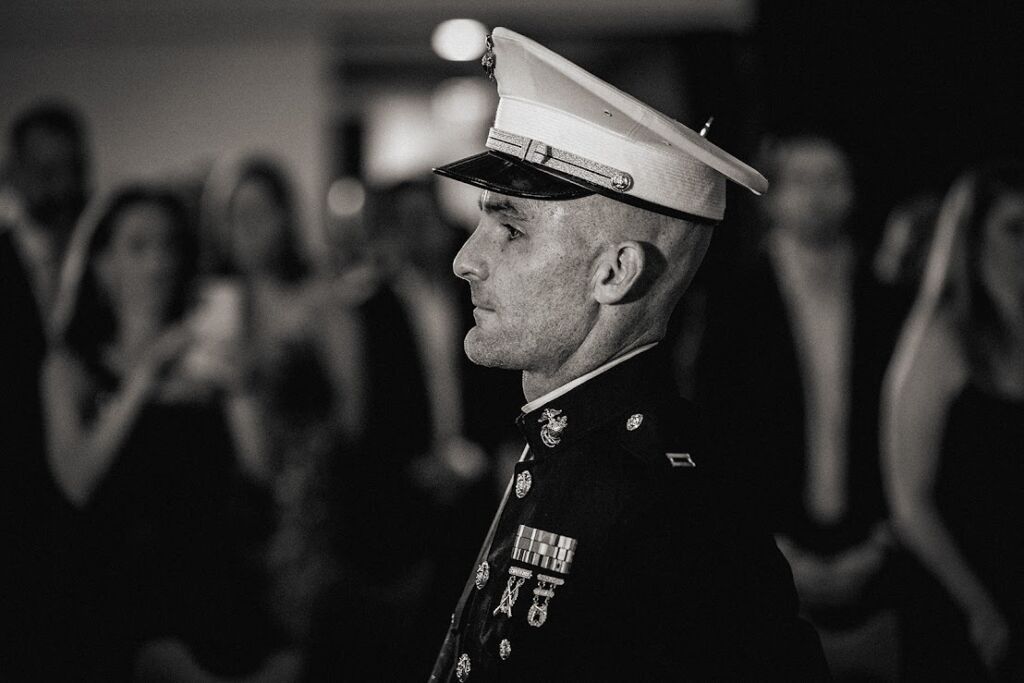

VETERAN OWNED & OPERATED

Why ETF Architect?

We have earned a strong reputation for education and innovation in the ETF space. We are veteran-owned and lean on Marine Corps values to guide our actions.

Affordable

Turnkey

Transparent

We are focused on client education and platform transparency so our clients can make great decisions. Transparency sets the tone for the long-term relationships we build.

Powered by Tech

Vertically Integrated

Skin in the Game

ETFs for all sponsor & asset types.

- Independent RIA

- Family Office & UHNW

- Mutual Funds

- Hedge Funds

- Banks and Brokers

- Institutions

- Consultants

- US Stocks

- Developed Stocks

- Emerging Stocks

- Fixed Income

- Commodities

- Futures and Options

- Fund of Funds

Save time. Save Money. Save Effort.

<4 Months

50%+ saved

50+ tasks

FOR LESS HASSLE CALL IN THE MARINES

Tax-Free Conversions or New ETFs, we’ll manage every step.

Your ETF is backed by best-in-class operations, technology, and the Marine Corps ethos of doing more with less and accomplishing the mission.

New Strategy ETF Example Fund

Perth Tolle approached our firm in 2018 and asked that we let her leverage our low-cost and efficient ETF infrastructure. We partnered on her Freedom 100 ETF launch, which is based on her proprietary Life + Liberty Indexes. The ETF was launched in 2019 and has grown from $5mm to over $400mm in the last few years.

SMA to ETF Example Fund

Mutual Fund to ETF Example Fund

Bridgeway Capital Management, a 29-year-old mutual fund firm, decided to partner with our firm to convert several of their mutual funds into ETFs to harness the operational, distribution, and tax efficiency of the ETF structure. BBLU and BSVO transitioned over $1B in assets into the ETF structure via a tax-free conversion.

Hedge Fund to ETF Example Fund

An investor should carefully consider the investment objectives, risks, fees and other expenses carefully before investing. Click the link to the applicable prospectus in the table above. Read the prospectus carefully before investing.

All investments are subject to risks, including the loss of money and the possible loss of the entire principal amount invested.

Distributed by PINE Distributors LLC.